If you’ve been struggling with debt from a merchant cash advance, you might wonder: “Should I hire a merchant cash advance attorney?”

Merchant cash advances are becoming an increasingly popular form of business financing, particularly for small businesses. Unlike traditional bank loans, merchant cash advance lenders don’t require good credit or a lengthy application process. In fact, they’re not loans at all. Instead, they’re an advance on a company’s future sales. MCA lenders can provide cash to your bank account in as little as 24 hours.

The problem is that MCAs are not loans, and there needs to be more regulation around how providers operate. MCA lenders typically charge hefty fees and provide an advance based on a percentage of future sales rather than applying high interest rates. For struggling business owners needing more reliable cash flow, taking out a merchant cash advance can quickly spiral into a cycle of debt.

Sound familiar? If you’re currently experiencing legal issues related to MCA debt, you might wonder if you need to hire a law firm for help. So, if you’re one of the small business owners facing a lawsuit, UCC lien, or a judgment against you, here’s what you should know about hiring an MCA attorney.

MCA Attorney vs. Debt Relief Firm

Resolving merchant cash advance debt involves navigating complex financial and legal challenges. Both merchant cash advance attorneys and debt relief firms offer services aimed at helping businesses manage or reduce their MCA debt. Still, they do so in different ways and with different expertise.

Merchant Cash Advance Attorney

- Legal expertise: An attorney specializing in merchant cash advances has specific legal knowledge and experience. They can provide legal advice, represent you in court, and negotiate with creditors from a legal standpoint.

- Litigation and defense: If your MCA issues escalate to a lawsuit, an attorney can defend your business in court. They can also identify any illegal practices by the MCA provider, such as usurious interest rates, and use these as leverage in negotiations.

Debt Relief Firm

- Debt management focus: Debt relief firms specialize in negotiating with creditors to reduce the amount owed or restructure payments.

- No Legal Representation: Most debt relief firms do not provide legal representation. A debt relief firm might be insufficient if your MCA issue involves litigation or complex legal matters.

What Does an MCA Attorney Do?

Attorneys are legally bound to act in your best interest. You are the client, and debt attorneys have an ethical obligation to communicate clearly upfront about fees and service terms, usually during your consultation. Your funds are often insured when paying money into the attorney escrow account. This gives added reassurance that your money for debt resolution is secure. They can advise you on legal details and represent you in and outside the courtroom.

Some of the services that an attorney who focuses on MCA debt can provide:

- Take over communications with debt collectors;

- Help restructure your merchant cash advance with favorable terms;

- Settle your debt;

- Defend you in a lawsuit;

- Pursue a countersuit or claim against an unscrupulous MCA;

- File for bankruptcy, if necessary, and

- Resolve UCC issues.

Approaches for Managing Merchant Cash Advances

If your business is struggling with the high costs and frequent payments typical of MCAs, there are several strategies you could pursue (ideally, with the help of an MCA attorney) to make MCA debt more manageable:

Consolidate the debt with a term loan

A consolidation loan combines multiple MCA debts into a single loan, potentially with a lower, fixed interest rate and longer repayment term. This can reduce the overall monthly payment amount and simplify cash flow management.

Negotiate with MCA Providers

Directly negotiating with your MCA provider for better terms can sometimes yield a more manageable repayment plan. Some providers may be willing to adjust your repayment schedule, reduce the factor rate, or offer other concessions to help you manage your debt, especially if the alternative is a default.

Try to settle the debt

It may be possible to settle the MCA debt for less than you owe. Your proposal should be realistic, based on your ability to pay, but also attractive to the MCA funder. Considering your financial constraints, it’s also important to make it clear that the settlement offer is the best way for the lender to recoup as much of the advance as possible.

Consider bankruptcy

As a last resort, filing for bankruptcy might be a way to restructure or discharge MCA debts, depending on the type of bankruptcy filed (e.g., Chapter 11 for reorganization or Chapter 7 for liquidation). This step can have significant legal and financial implications for your business and should be considered carefully with professional advice.

Sue the MCA funder

If the MCA funder misrepresented the terms of the cash advance, engaged in deceptive practices, or committed outright fraud in their dealings with you, legal action could be a way to seek recourse. Again, be sure to work with a reputable and experienced MCA attorney if you plan to file a lawsuit.

When Should You Hire an MCA Attorney?

Now that you better understand what an MCA attorney does, you can better answer the question: “Should I hire a merchant cash advance attorney?”

Below are a few more questions you can ask yourself to help you decide.

Is your MCA debt impacting your business negatively?

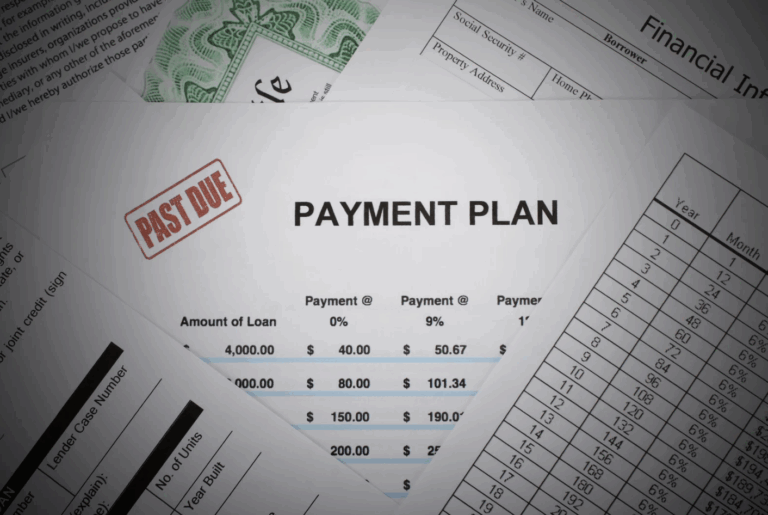

Unlike a business loan from a bank, MCA payments are taken directly from your receivables. Withdrawals are made from your business bank account daily or weekly. That can make it challenging to manage your existing expenses and maintain positive cash flow. An expensive MCA can compound any financial issues you’re facing, putting you in danger of defaulting.

An attorney can help you restructure your MCA so that payments don’t drain your business. They will ensure the terms of the agreement are more favorable to you while ensuring that your rights are protected.

Are you in default?

When you miss your MCA payments, you’re considered to be in default. Defaulting on your MCA payments often constitutes a breach of contract. This can have many serious consequences. For one, your creditors can turn over your original debt to debt collectors, who will contact you repeatedly and demand payment.

Your MCA provider may also file a lawsuit against you or send UCC liens notices to your payors. A reputable MCA debt help lawyer can represent your case and advise you on the best way to handle past due MCA debt and help protect the legal rights of your business.

Is there a UCC lien against your business?

The Uniform Commercial Code (UCC) is a set of laws that govern all commercial transactions in the U.S. If you default on an MCA, the provider can file a UCC lien against you. This common practice can happen within days of missing MCA debt payments and breaching your contract.

A UCC lien can be placed against equipment, inventory, income, and other assets. The merchant cash advance company can contact your customers and payment processors and request that they pay the funder directly instead of you. Not only is this an embarrassing situation, but it means you have even less income to pay off your debt (not to mention cover your bills). It can hurt your business operations and possibly your reputation in your industry.

An MCA attorney can assist with disputing a UCC lien. And if you’ve satisfied your debt, they can ensure it is removed, as legally required.

Did you sign a confession of judgment?

A standard provision in MCA contracts is a confession of judgment (COJ). This essentially strips away your right to defend yourself in court if the MCA provider sues you. Instead, a judgment is entered against you without notice. This allows the MCA company to skip court proceedings and begin freezing accounts, possessing assets, etc.

An attorney can help you deal with a judgment and have it reversed. It was a common practice for MCA providers to file COJs in New York, where the courts were much more amenable. However, as of 2019, COJs are no longer enforceable for non-New York residents. An attorney will know your legal rights.

Hiring an MCA Attorney: Next Steps

Hiring a legal professional is usually good when dealing with MCA debt. Few regulations surround merchant cash advances, and the contracts often contain confusing jargon. You don’t want to risk the health of your business or your finances by trying to deal with MCA debt on your own.

Tayne Law is highly experienced in helping clients resolve their MCA and other types of consumer and business debt. We can review your situation and devise a plan that keeps your business and personal matters intact.

If you want to stop dealing with MCA debt and collectors and get back to focusing on your business, give us a call at (866) 890-7337 or fill out our short contact form. We provide a free, no-obligation phone consultation to learn about your options and how we can help. We never sell or share your information and will keep your matter confidential.

How MCA debt relief works

From our first discussion to the moment we secure a deal, your journey with us is designed to be easy and worry-free. Rest assured that you’ll receive the support you need every step of the way.

- Arrange your complimentary consultation: In this initial phone discussion, we’ll collect details about your business and financial obligations.

- Make your first payment: Once we receive your first payment, our team assumes responsibility for all interactions with your creditors. This transition allows for a smooth and efficient process, giving you the freedom to concentrate on managing your business operations.

- We’ll contact your creditors: After you give the go-ahead, we’ll promptly contact your creditors. This proactive approach helps us begin addressing any financial concerns without delay, aiming for a swift resolution.

- Getting your business back on track: Throughout this journey, we’ll keep you well-informed and work diligently to lift the burden of your merchant cash advance obligations. Our goal is to provide your business with the necessary financial relief to thrive.

Frequently Asked Questions

Settling MCA debt involves a strategic approach starting with a thorough assessment of your business’s financial situation and gathering all relevant documentation related to your MCA. Getting professional assistance from a debt settlement attorney can help your negotiation leverage. Negotiations may require flexibility, but ensure any agreement reached is documented in writing. You should document the settlement amount, payment schedule, and conditions. Follow through with the agreed payments diligently and keep records.

Yes, you can negotiate MCA debt. Negotiation can involve adjusting the repayment terms, reducing the payment amounts, or even settling the debt for a lump sum less than the total amount owed.