Struggling with credit card debt can be stressful enough. Being sued by your credit card company can feel downright scary. Plus, you might not know what to do next.

One of your options is hiring a credit card debt lawyer. But you might wonder if doing so is necessary — or worth it. You technically don’t have to hire a lawyer, and data from the Pew Research Center finds that less than 10% of defendants in debt collection lawsuits have legal counsel. However, those that do are more likely to win their case or reach a settlement.

In other words, hiring a law firm is probably in your best interest. So here’s what you should know about working with a credit card debt lawyer when facing a lawsuit.

What Happens When a Credit Card Company Sues You?

If you fall behind on your credit card payments, your credit card company has a few options. Once you’re at least 180 days late on monthly payments, the original creditor may charge off the debt, sell it to a collection agency or other debt buyer, and/or file a lawsuit.

The goal of a lawsuit is for them to get paid. That’s usually accomplished by forcing a settlement for less than what you owe or getting you on a payment plan. Remember that third-party debt collectors can also sue you in certain situations.

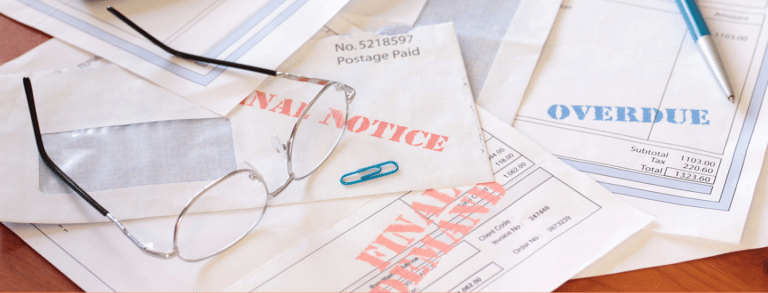

If that happens, you’ll receive a complaint letter and court summons. The paperwork contains important information about the lawsuit, including who is suing you, how much they’re trying to collect, the hearing date, and more. This could come in the mail or be left by a process server at your home or work.

You must respond to the lawsuit in a timely manner. Ignoring it will only result in a judgment against you. That is called a default judgment.

How a Credit Card Debt Lawyer Can Help

If you decide to work with a credit card debt attorney, there are several ways they can help. First, they can determine whether the plaintiff has followed debt collection laws and whether the creditor has a case against you. If not, your lawyer can help get the case dismissed. They can also help you answer the complaint, develop a defense, and represent you in court.

An attorney can also help you protect your rights in debt collection cases. A lawyer will know the Fair Debt Collection Practices Act (FDCPA) and can help ensure that a debt collector doesn’t violate your rights or face consequences if they don’t follow federal law.

Another way a credit card debt lawyer can help is by negotiating a settlement on your behalf. Working out a settlement can help you avoid going to court and simply settle your debt.

Settling a credit card debt involves working out a deal with the creditor to pay less than you owe. Usually, this is only possible if the lender believes they won’t be able to collect the full amount from you. Part of the process involves stopping payments on your cards and becoming delinquent. This is done to try to force an agreement to settle your debt. Because this can be a delicate situation with legal and financial consequences, including impacting your credit score, it’s often a good idea to involve an experienced debt relief lawyer.

Should You Hire a Credit Card Debt Settlement Attorney?

It’s usually a good idea to hire a debt relief attorney if you’re facing a credit card debt lawsuit, being harassed by creditors, feeling overwhelmed with resolving debt on your own or simply wanting it done right. Here are a few instances when it’s an excellent idea to hire legal representation for help with your debt.

1. You’re not sure what to do.

The legal system can be complex and confusing. So can resolving debt in the collection world. Most people aren’t going to know exactly how to navigate it. And missing an important step could result in serious legal ramifications.

For instance, if you don’t respond to your lawsuit, you could end up with a judgment against you. That means owing the original debt plus court fees and interest. If you can’t pay, you could be subject to wage garnishment or have your bank accounts frozen and property seized.

You could also accidentally restart the clock on the statute of limitations on old debt by saying something wrong or signing something you shouldn’t have. You might also give up certain rights or agree to a deal you can’t realistically afford.

Hiring a credit card debt attorney can give you peace of mind and help you avoid mistakes. You will get a clear picture of the steps you need to take and the possible outcomes of your case. You can also direct creditors to communicate through your attorney instead of you directly, relieving the pressure of constant phone calls and letters.

2. You have a defense.

Just because you’re being sued doesn’t mean you’re doomed to pay. There are many situations in which you could win your case. For example, the statute of limitations may have passed on your debt. This means that too much time has passed since you became delinquent so that the creditor can legally sue you. The statute of limitations varies by state but is usually around three to six years.

Another situation that can lead to having your case dismissed is if you don’t actually owe the debt and can prove it. This may happen if you’re the victim of identity theft or the creditor simply made a mistake. In this case, your attorney can require the creditor to produce the original contract. Here, you can verify whether it contains your signature and accurate personal information.

If you believe you have a defense, hiring a lawyer who knows the ins and outs of the debtor and creditor laws can be helpful. They can help craft an effective defense and strategy in court. And these are just a couple of possible defenses — a lawyer can review your case and pinpoint other opportunities to fight the lawsuit.

3. You’re hoping to settle the debt.

It’s possible to settle a debt on your own. However, you might not have the advanced negotiation skills that experienced attorneys do or the deep knowledge of debt collection laws. Plus, dealing with a lawsuit is stressful enough — you might not want the added pressure (or extra time involved) of negotiating with creditors.

A credit card debt lawyer is highly knowledgeable in this area. They can help negotiate a better outcome than you might be able to. That could mean saving thousands of dollars more while avoiding time in court and stress on your day-to-day life.

If a creditor is suing you, know you don’t have to deal with it alone. Dealing with a lawsuit independently is possible, but a lawyer can make the process much less stressful, confusing, and time-consuming. And even though it can cost you more money upfront, hiring a lawyer can result in a better deal. That may be a settlement where you pay a fraction of your unpaid credit card debt. Or you may not owe anything at all with a solid defense. Either way, you could save yourself quite a bit of money and headaches in the long run.

If you still aren’t sure whether hiring a credit card debt attorney is worthwhile, know that you don’t have to commit right away. Here at Tayne Law Group, we’re happy to provide a free consultation and walk through your options, giving you time to decide whether it’s the right decision for you. Call us at (866) 890-7337 or fill out our short contact form for us to contact you and educate you on your options to learn more.