Can MCA Lenders Take Your Personal Assets? What to Know About Personal Guarantees

Quick Summary If you signed a personal guarantee, MCA lenders can pursue your personal assets. It’s important to be familiar with the details of your contract and understand your legal options. Introduction Merchant cash advance (MCA) agreements often include personal guarantees, which are clauses that make you personally responsible for the debt if your business […]

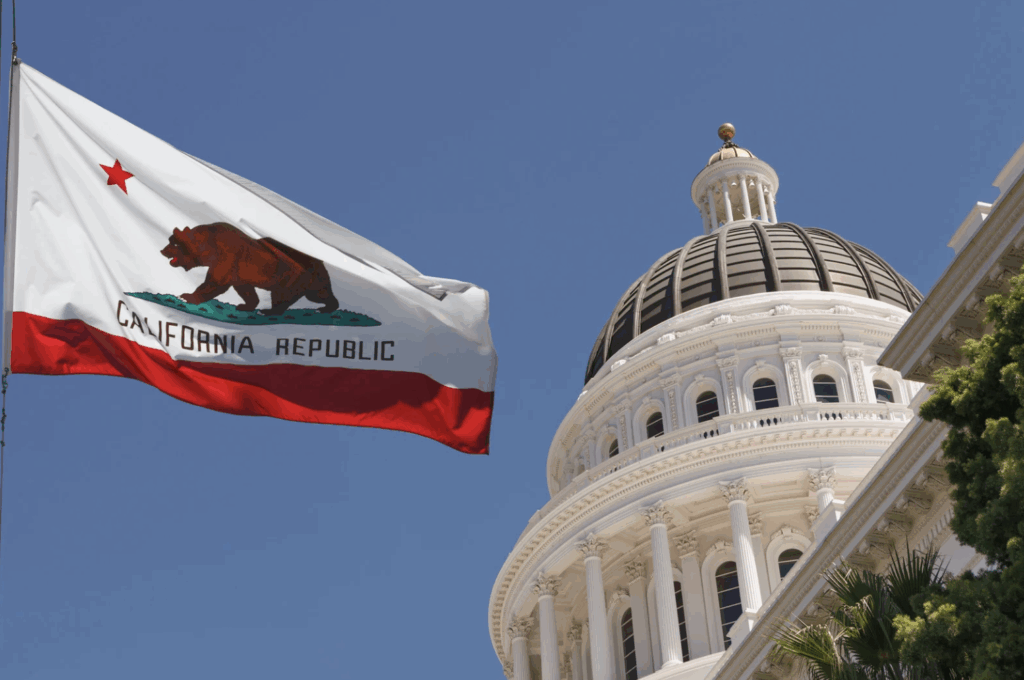

What California’s New MCA Debt Collection Protections Mean for Your Business

Quick Summary As of January 1, 2025, California’s Rosenthal Fair Debt Collection Practices Act (RFDCPA) extends consumer-style protections to small business debts, including merchant cash advances. MCA borrowers can now demand debt verification, challenge harassment, and report violations to regulators. Introduction A key criticism of merchant cash advances (MCAs) is their lack of protection for […]

What Happens When MCA Debt Interferes With Payroll, and How to Prevent It

If you took out a merchant cash advance (MCA), the size and frequency of payments can drain your bank account before you even have a chance to think about payroll. And some business owners eventually realize the gravity of their situation when payday arrives and the funds simply aren’t there. Unlike missing a supplier payment […]