Sexism is still prevalent in our society and, sadly, extends to small companies. Women-owned businesses are still fighting for equal opportunities and fair treatment when it comes to small business lending. We ran a study that revealed some shocking findings about gender-based approval rates for business loans.

In this blog, we will delve into the data and different business statistics from our survey respondents, as well as statistics from census data available on the Small Business Administration (SBA) website.

The Demographic Makeup of Our Survey

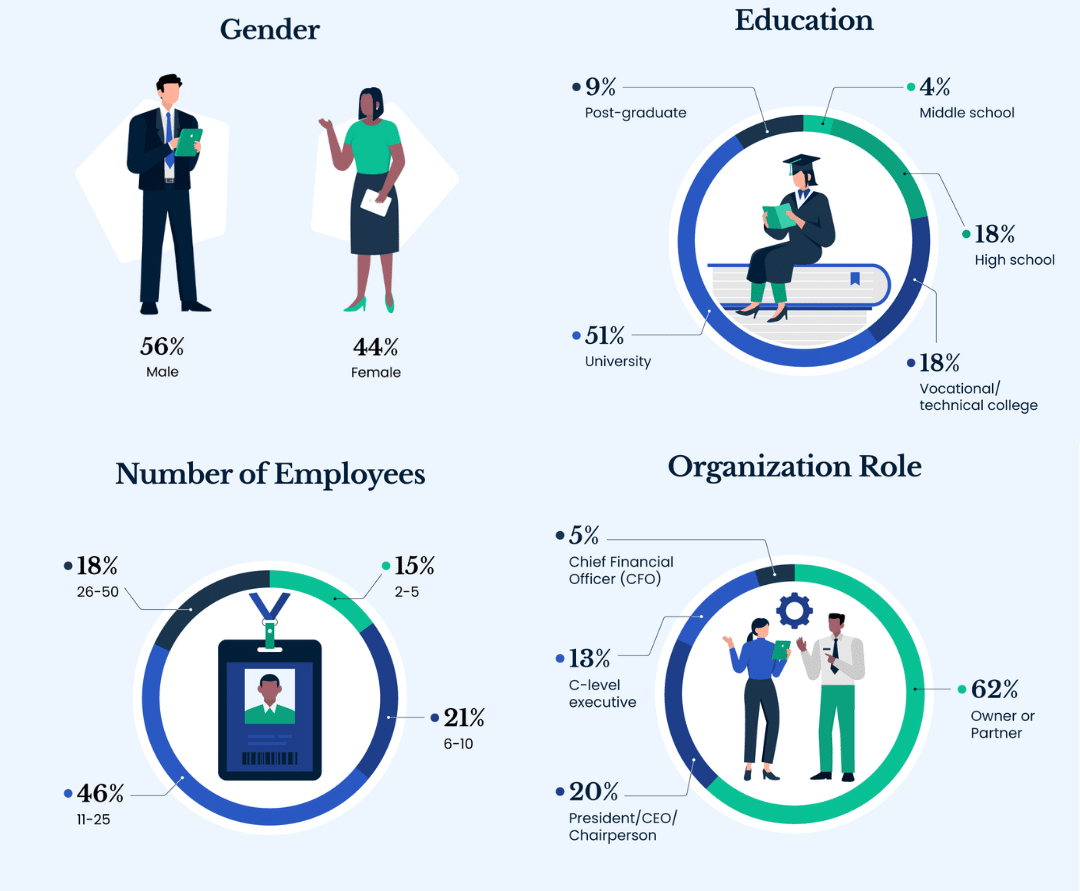

Before we begin, let’s take a quick look at the demographic data of our survey respondents so you have a better idea of who we were talking to about an SBA Loan. For clarity’s sake, this is a United States-based survey.

Out of the respondents we surveyed, the split was fairly evenly distributed between men and women. Business owners surveyed were all in leadership/ownership roles, and the majority had a college degree. Lastly, every business had at least two employees.

Business Loans: Men Vs. Women

In addition to traditional loans from small banks, online lenders, large banks, and commercial banks, the government is still forgiving PPP and other COVID-related loans. If a business owner applies for a line of credit, it shouldn’t matter whether they’re a man or woman, but our results showed differently.

The first two questions we asked our business owners were if their business loan applications had been denied, and if they were denied any business lines of credit pre-COVID, were they able to receive one of the business loans available during the pandemic.

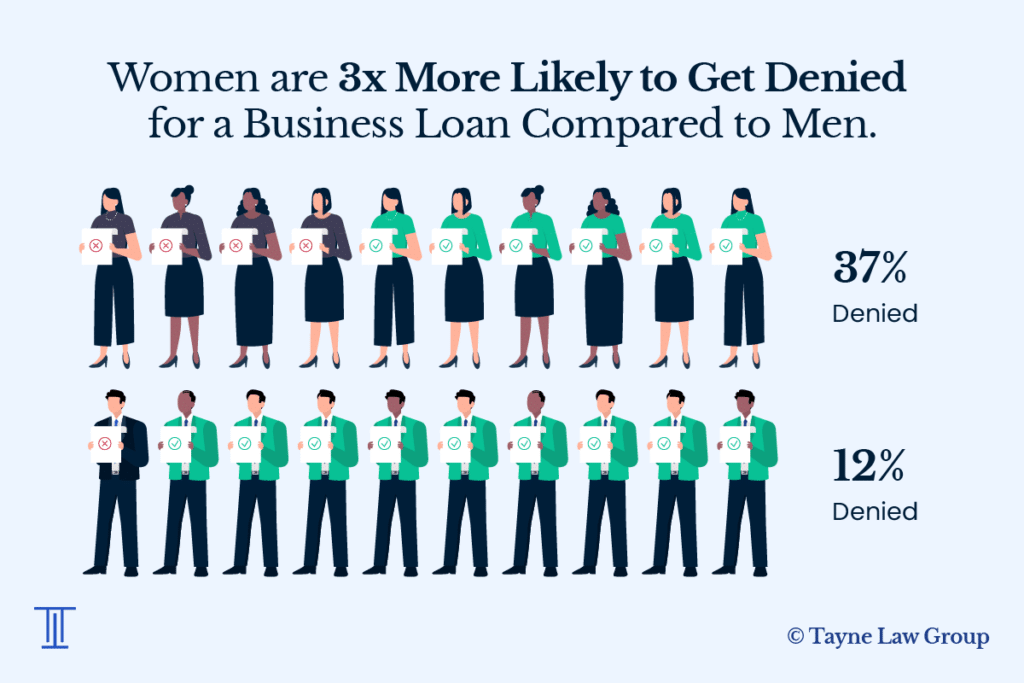

Men are 3X More Likely to Get a Business Loan Than Women

Access to capital is important to many entrepreneurs and small business owners. There are many factors that go into qualifying for a loan from big banks, such as a good credit score. But one thing that shouldn’t matter is if it’s a women-owned small business. We took a deep dive into the world of small business loans and explored gender-based approval rates for business loans pre- and post-pandemic.

This is what we learned:

- Female business owners had a more challenging time getting loan applications approved in both cases.

- Pre-pandemic, 85% of men surveyed received a small business loan, while only 36% of women were approved.

- During the COVID-19 pandemic, 90% of male business owners received a business loan, while only 50% of female business owners did.

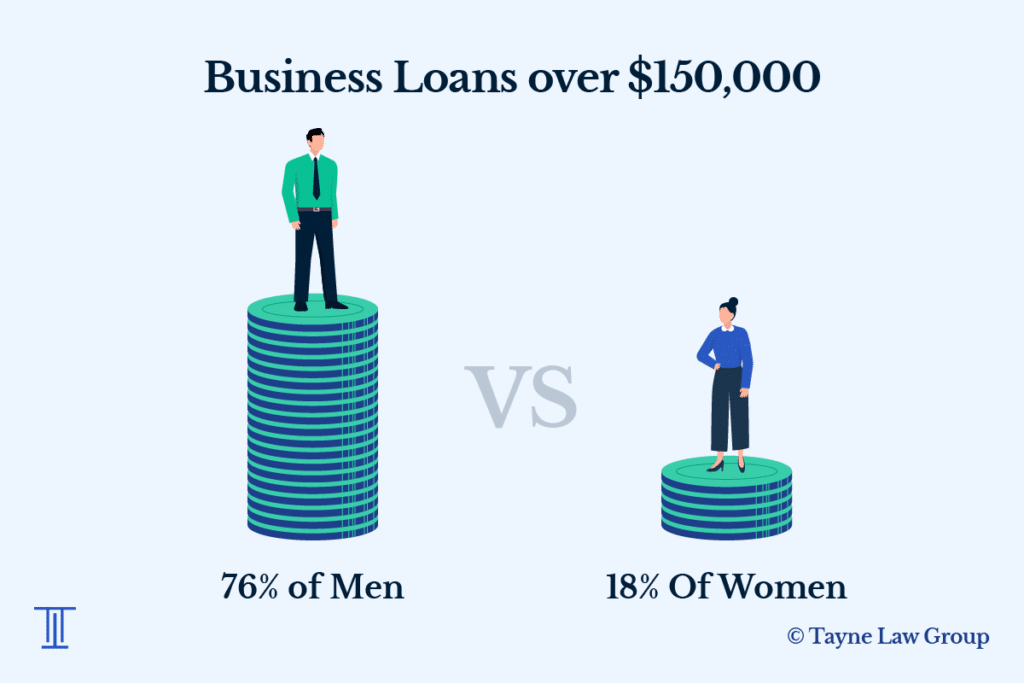

Men Are More Likely to Get a Business Loan Over $150K Than Women

After gaining insight into loan approvals for business owners without bad credit, we examined the average small business loan amount to see how much females were getting compared to their male counterparts.

The results were surprising.

Our survey showed that women-owned businesses are often approved for lower loan amounts than male-owned businesses. Before the COVID-19 pandemic, women-owned businesses were approved for loans in amounts much lower than male-owned businesses.

- Overall, female-owned businesses received smaller loan amounts than male-owned companies.

- 76% of men received a loan for more than $150,000, while only 18% of women received loans for this amount.

- No females received a loan for more than $500,000, but 2% of male-owned businesses did.

- No males received a loan for less than $10,000, but 15% of women-owned companies did.

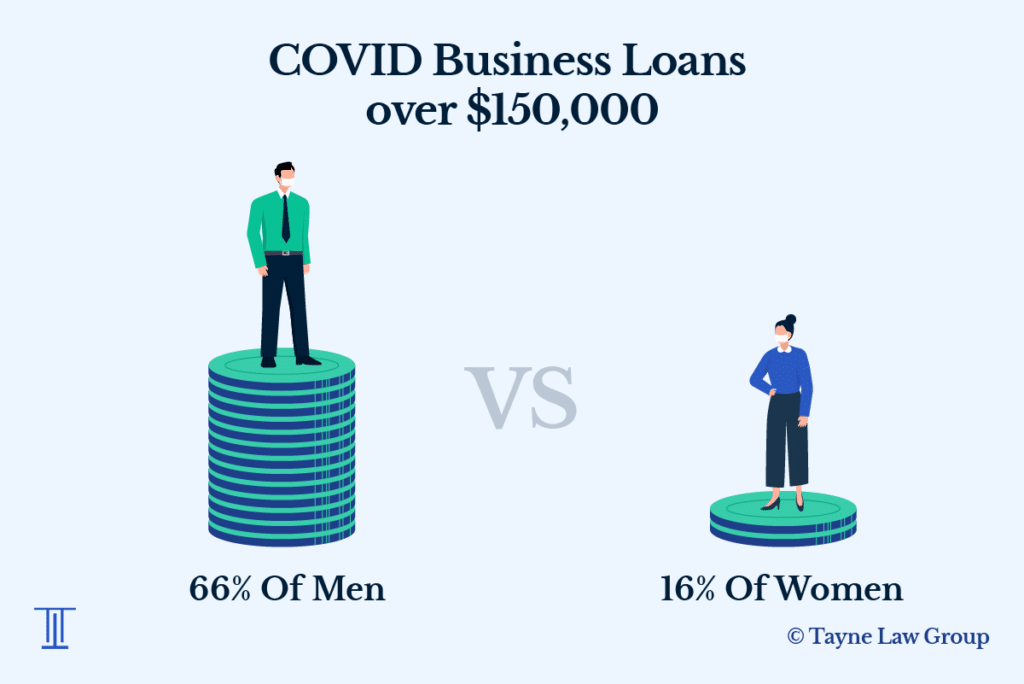

In the wake of the COVID-19 pandemic, both men and women experienced difficulties when it came to business shutdowns and limited occupancy requirements. For female businesses trying to get loans, the challenges they faced in accessing the capital needed to grow their business was greater than for their male counterparts. When it comes to dollars given, men still received a larger piece of the pie post-COVID for small business financing.

- Loans over $500,000 were matched 2% to 2%.

- 3% of men received a minimal loan under $10,000, and 30% of women-owned businesses did.

- Only 16% of females received loans over $150,000 compared to 66% of males.

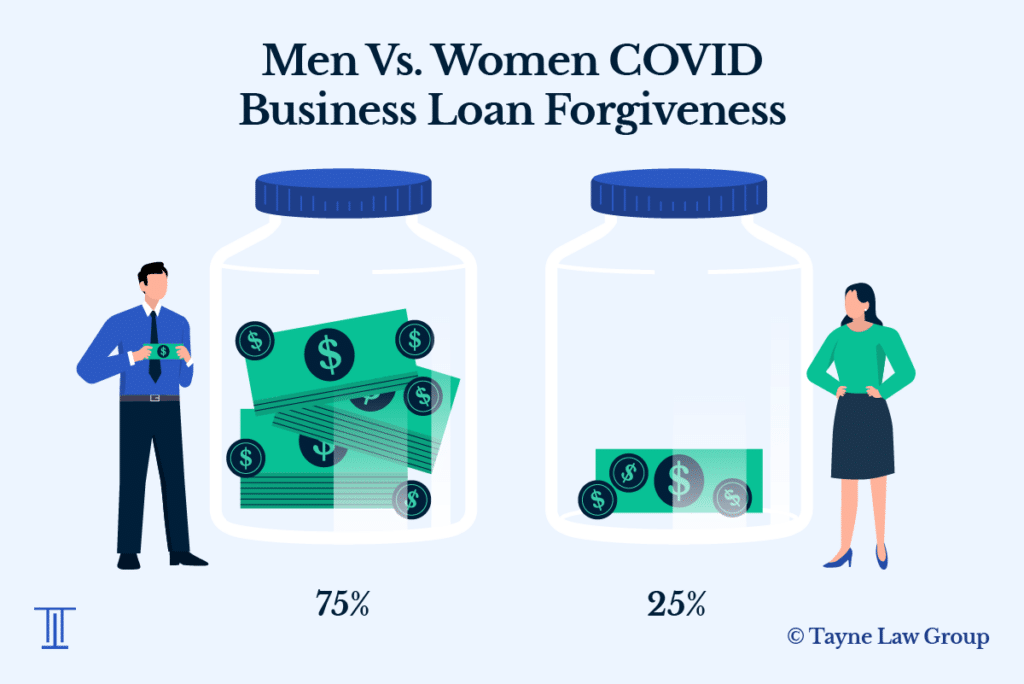

50% Loan Forgiveness Gap Between Men and Women

The last piece of the puzzle was seeing how male- and female-owned businesses fared regarding loan forgiveness.

The findings:

- No male-owned business received $0 in forgiveness, but 12% of female borrowers were given no loan forgiveness.

- Only 25% of female business owners had most of their loan forgiven when 75% of male-owned businesses did.

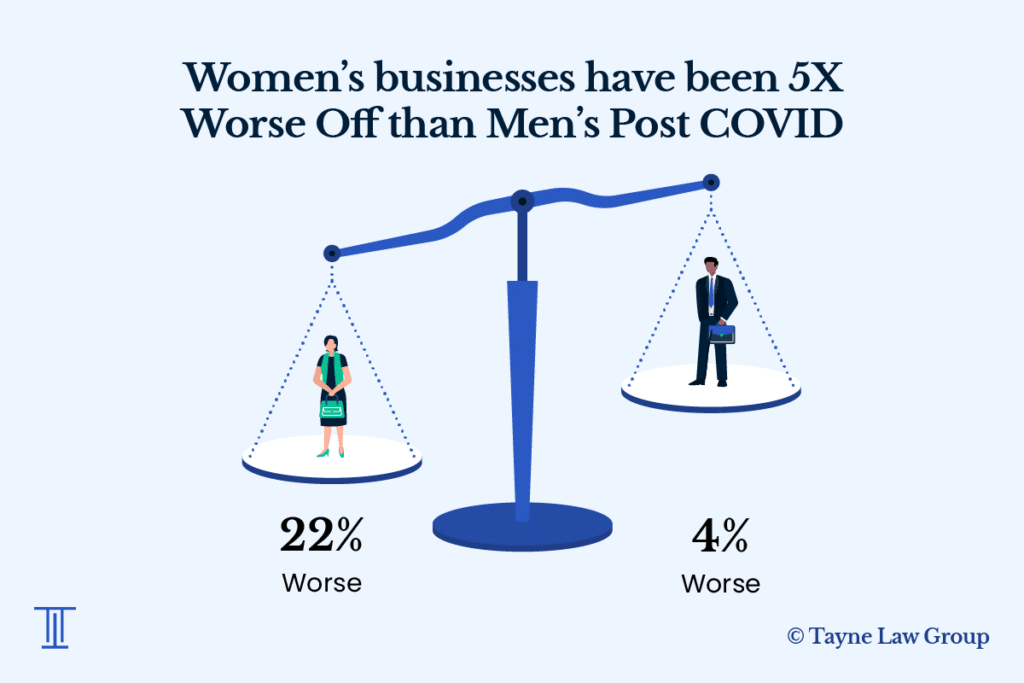

It’s not surprising to see that women-owned businesses are worse off post- COVID, given the amount of money loaned to small businesses and how much was forgiven.

What Is the Current Small Business Landscape?

Recent reports from the Small Business Administration and Federal Small Business government page provide valuable insights into the current landscape for small businesses. Many firms still struggle post-pandemic, and women own 80% fewer businesses than men.

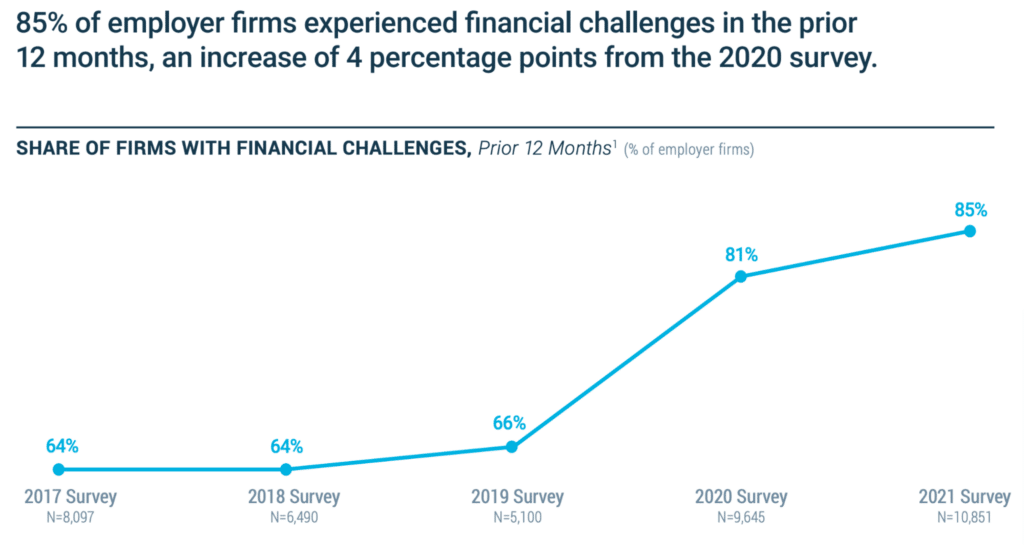

- 85% of firms report financial challenges (Fed Small Business)

- 66% of small business owners expect revenue increases (SBA)

- More than half plan to expand their business in 2023 (SBA)

- The SBA will expand the number of community financial institutions enrolled in Lender Match by 20% (SBA)

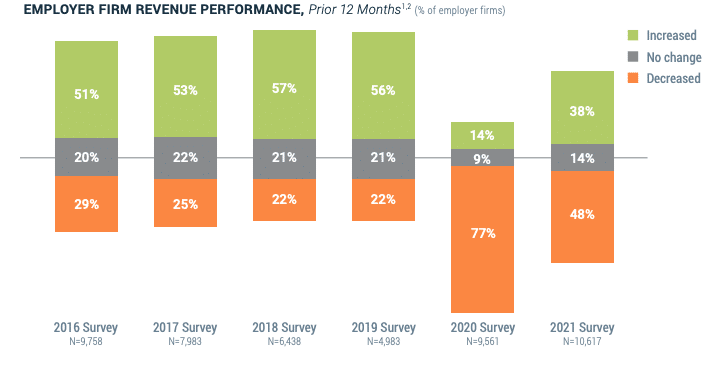

- Employer firm revenue and employment trends indicate that some firms are recovering from the initial effects of the pandemic, though more firms reported continued declines in revenue and employment during the prior 12 months.(Fed Small Business)

- The percentage of U.S. small businesses reporting decreases in the number of paid employees in the last week increased from 12.4% to 13.5% (SBA)

- 19.9%, or about 1.1 million businesses with employees, are woman-owned. (SBA)

Sources of Business Loan Financing

It is crucial for entrepreneurs to have a solid business plan and improve their credit score to enhance their chances of getting approved for a business loan. Some of the common sources for borrowing are merchant cash advances, loans from small or large banks, lenders, friends or family, and SBA loans.

- 27% of businesses surveyed by the NSBA claimed that they were not able to receive the funding they needed. For those 1-in-4 businesses, the most frequent primary impact that a lack of funding had was preventing them from growing their business.(SBA)

- Entrepreneurs often source capital from their personal and family savings to get their business off the ground (SBA)

- 75% of new businesses use their personal finances

- 19% report using a bank loan for startup capital

- 17% of new employer businesses report using credit cards

- 11.3% of new employer firms used no capital

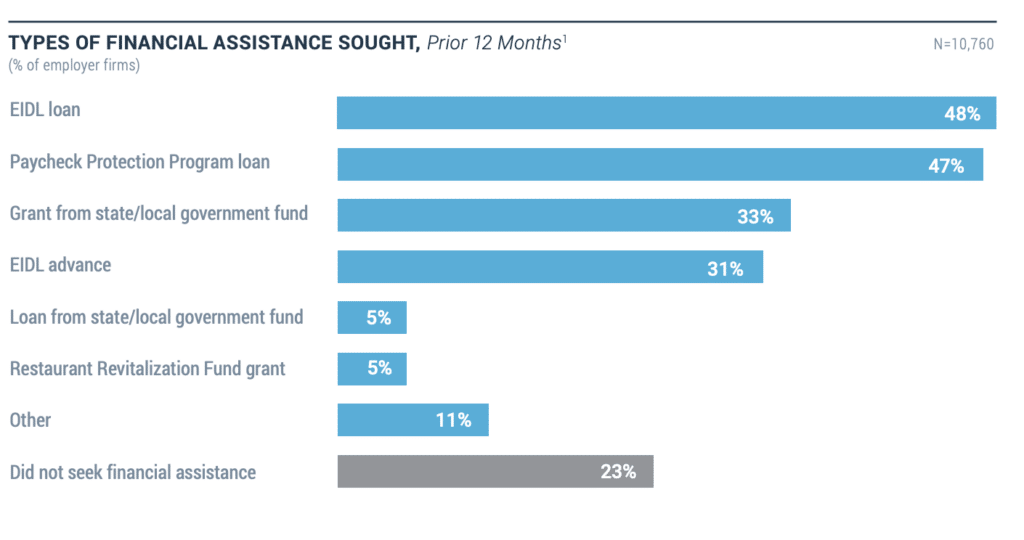

- During COVID, most small businesses used the Economic Injury Disaster Loan – 48% (SBA)

Small Business Environment Pre- and Post-COVID

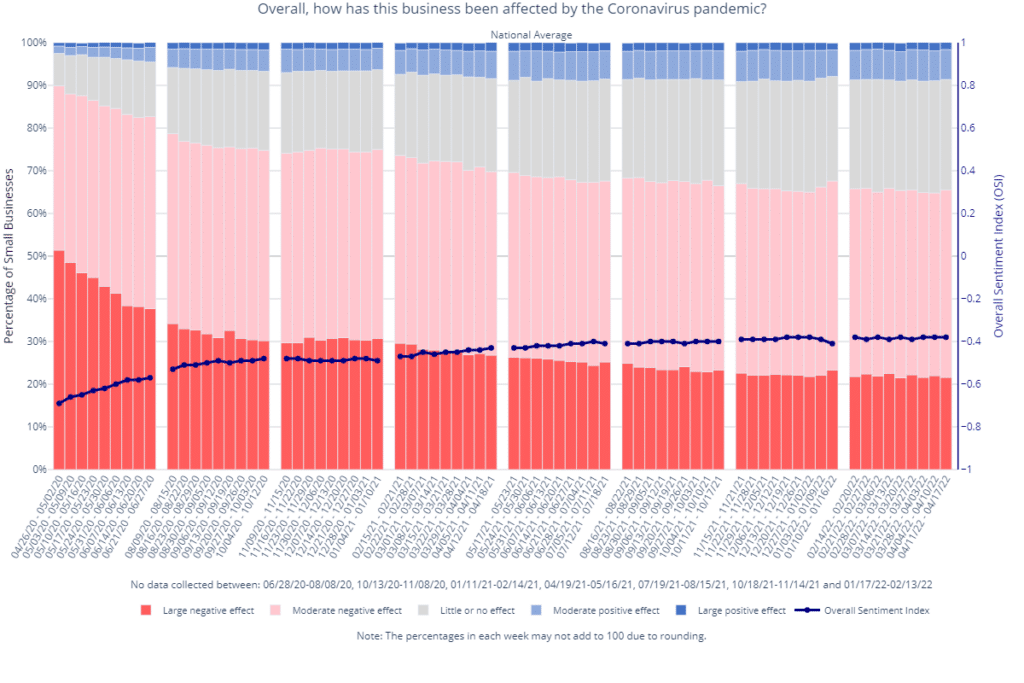

The government has implemented several relief programs to help small businesses during COVID and continues to offer different loans to help with overall economic growth. As the economy recovers, there are signs of improvement in small businesses, but challenges still persist for many businesses. The Small Business Administration (SBA) has current statistics and trends and has a live graph that is updated weekly that shows how businesses have been affected by the coronavirus pandemic.

- Between March 2020 and March 2021, 1.1 million U.S. establishments opened and 965,995 closed, for a net increase of 180,528. Small businesses accounted for 1.0 million openings and 833,458 closings.(SBA)

- Small businesses gained 8.7 million jobs and lost 11.7 million, for a net decrease of 3.0 million jobs.(SBA)

- From February to April 2020, employment fell by 18.1% among women and 14.2% among men. (CBPP)

- Business birth rates in the first year of COVID-19 exceed historical averages, but birth rates were even higher in the following year. (SBA)

- 23.4% of small businesses cited labor needs in August 2020, which increased to over 40% at the end of March 2022. (SBA)

- At the end of 2021, small establishments with 10-49 employees had over 3 million job openings, more than any other size group. (SBA)

SBA Business Loans Pre- and Post-COVID

The Small Business Administration’s Paycheck Protection Program (PPP) provided critical funding to many small businesses during the pandemic and continues to do so. Loan application rates for small businesses owned by women have been disproportionately lower than those owned by men.

- In the second half of 2021, small business loan shares (loans $1 million or less) decreased. (SBA)

- The share of applicants receiving all of the funding they sought fell from 51% in 2019 to 36% in 2020 to 31% in 2021. (SBA)

- The share of small firms that received the full amount of debt financing requested declined across all firm sizes in 2021 compared to 2019. The largest decline was in firms that have 1-4 employees. (SBA)

- 85% of employer firms experienced financial challenges in the prior 12 months, an increase of 4 percentage points from the 2020 survey. (SBA)

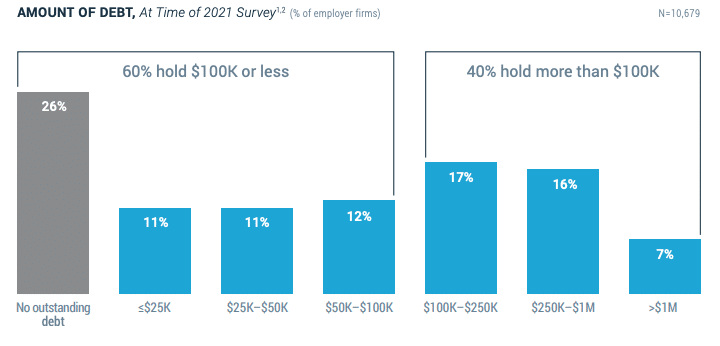

- 74% of employer firms have outstanding debt, down from 80% in 2020. (SBA)

- 6 in 10 firms have $100K or less in outstanding debt. (SBA)

FAQ:

When you have bad credit, it can sometimes feel like your financial options are limited. Fortunately, there are things you can do, like consolidating debt, applying with a co-signer, starting a debt payoff plan or a debt management program, and trying to settle your debt.

Small business loans provide businesses with the capital they need to start or run their business. There are many different types of loans therefore the way they work depends on the loan you took out.

As of January 1, 2022, SBA stopped accepting applications for new COVID-19 EIDL loans or advances. (SBA)

The Paycheck Protection Program (PPP) ended on May 31, 2021. There are other loans available though; existing borrowers may be eligible for PPP loan forgiveness.

Spread Awareness and Share These Stats on Business Loans

Despite the growth of women-owned businesses over the past few decades, gender bias still exists when accessing capital. For the most recent data on loan amounts, the SBA 7(a) & 504 Summary Report keeps an updated record of female and male loan approvals and amounts, showing the gap between female-owned and male-owned businesses.

Sexism in getting business loans from private institutions and those that fall under the Federal Reserve is a real problem that needs to be addressed. The Tayne Law Group study found that women entrepreneurs face significant disparities in approval rates and average SBA loan amounts compared to their male counterparts.

To overcome these challenges, women can seek alternative types of loans, use government loan programs for women business owners, build strong relationships with lenders, and reach out to Tayne Law.

It’s time we create an environment of equal opportunities for all genders in the world of business financing. As a female-owned law firm, Tayne Law supports women-owned businesses. Share this blog on Facebook and other social media platforms so we can help ensure that all entrepreneurs have an equal chance at success.