You turned to a debt settlement company hoping for relief from your merchant cash advance (MCA) debt. But instead, the situation has only gotten worse. Now, you’re facing aggressive collection tactics, mounting fees, and a financial crisis that threatens your business.

Unfortunately, this is a common story for many business owners who discover too late that traditional debt settlement approaches don’t work well for MCAs. If you’ve found yourself in this position, don’t panic — there are effective steps you can take to regain control of your finances and protect your business.

Examining the Role of Debt Settlement Companies

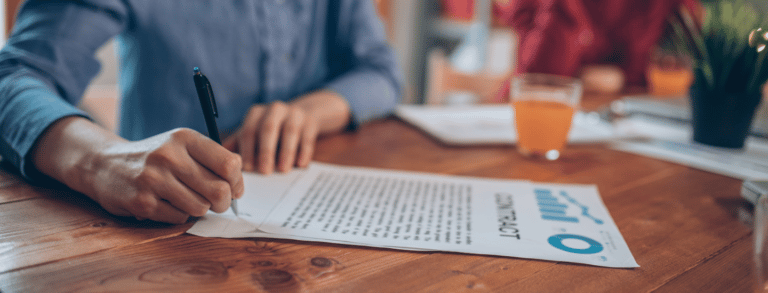

A debt settlement company is a business that helps individuals negotiate and reduce their unsecured debts (like credit card debt, medical bills, or personal loans) with creditors or debt collectors. These companies aim to settle debts for less than the full amount owed, providing relief to individuals who are struggling with overwhelming debt.

Misleading Promises

Debt settlement companies often have a mixed reputation because some engage in questionable or even downright unethical practices. Here are some of the common misleading promises you might come across with some debt settlement companies:

- Guarantees they can settle debts for a fraction of the amount owed: The truth is that success rates vary widely, and not all creditors agree to settle for pennies on the dollar. In many cases, clients may still face legal action and collections.

- Failing to fully explain the potential risks: Even though debt settlement is beneficial in many cases, there are some risks and downsides you should be aware of. These could include a significant drop in credit score, potential lawsuits from creditors, and additional interest, late fees, or penalties accrued during the negotiation process. Shady debt settlement companies are usually not upfront about these risks or the costs associated with debt settlement.

- Promises of a quick resolution: Debt settlement is usually a long process, and can even take a year or longer to complete. Don’t believe any company that guarantees it can be done in a few weeks, or for exact amounts especially before knowing your unique circumstances.

- Specific settlement amounts: Statements like “We guarantee to reduce your debt by 50% or more” are misleading because creditors are not legally obligated to negotiate or accept settlements. Individual outcomes depend on factors like the creditor’s policies, your financial situation, and the negotiation skills of the company.

Failing to work with a reputable debt settlement company can have many negative consequences. For one, these companies often charge high fees, sometimes upfront (which is illegal in the U.S.), or monthly potentially leaving you worse off financially. Some fraudulent companies may fail to resolve your debts, leaving you vulnerable to collection efforts and legal actions while pocketing your money.

That’s why if you’re going to pursue help with MCA debt or even credit card debt, it’s imperative you choose a respected legal professional with a strong track record who can guide you through the best course of action for your business and the specific debts.

Compatibility with MCAs

The debt settlement model often fails when dealing with merchant cash advances — namely, because of their unique structure.

MCAs are structured as a purchase of future receivables rather than a loan. The MCA provider buys a portion of your business’s future sales, making it difficult to negotiate the terms as traditional debt. Additionally, because MCAs are not loans, they often fall outside the purview of usury laws and traditional debt settlement frameworks, limiting leverage for negotiation.

Additionally, many MCA agreements require merchants to sign a confession of judgment (COJ), allowing the lender to obtain a judgment and seize assets without a court hearing if the borrower defaults.

Finally, MCA providers make money from high fees, primarily through the factor rate. Settling for a lower amount reduces their potential earnings, and their contracts often include clauses that prioritize full collection.

Alternative Solutions and Recommendations

Due to the nature of MCAs, attempting to work with MCA debt settlement companies may not be your best option when it comes to resolving your debt. Instead, you may want to consider a legal alternative.

MCA Reconciliation

Merchant cash advance agreements often include a provision called a reconciliation clause, which is designed to adjust payments if your revenue declines. In this case, the MCA provider must restructure the terms of the advance when unmanageable payments threaten your business’s viability.

To initiate reconciliation, you’ll typically need to notify your MCA provider as soon as possible and often supply documentation proving a drop in your receivables. Once verified, the provider should adjust the payment terms, reducing the amount you owe until your revenue stabilizes.

If the MCA provider refuses to honor the reconciliation clause, they may be breaching the contract. In such cases, consulting with a MCA debt help lawyer can help you enforce the agreement and resolve the issue.

MCA Consolidation

Consolidating MCA debt is another potential solution. This involves taking out a lower-interest installment loan to pay off one or more MCAs. With consolidation, you simplify repayment by focusing on a single loan with fixed monthly payments.

However, eligibility for consolidation loans often hinges on having good credit and release of UCC liens. If your business credit score has been negatively impacted by missed payments or collection actions on an MCA, securing a traditional loan with favorable terms could prove difficult. In that case, consolidation may not be the most viable option.

Speak to an Experienced MCA Attorney

An MCA debt help attorney can help you manage a merchant cash advance, whether that’s restructuring your MCA debt or pursuing another solution. They can also defend against aggressive collection tactics and represent you in legal disputes to protect your assets and rights.

Tayne Law has been helping clients resolve their business debts for over two decades. We know the ins and outs of MCAs and their complicated contracts. We may be able to help you deal with MCA debt in a way that fits your budget and allows your business to continue operating. So call us at (866) 890-7337 for a free, no-obligation phone consultation with an experienced MCA debt team member or fill out our short contact form. All conversations are confidential, and we never share or sell your information.