Receiving a debt collection letter can be an anxiety-producing experience. If you’ve recently gotten one in your mailbox, you’re likely looking for someone to turn to for help with a collection letter. Fortunately, we have the information you need before moving forward.

Below is a guide to responding to an attorney’s collection letter. Read it over to learn about what a debt collection letter is and what steps you can take to resolve this issue.

What is a debt collection letter?

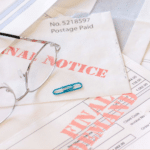

At its core, a debt collection letter is a formal, written request asking the borrower to resolve their outstanding debt, such as credit card debt. Ultimately, while this type of letter informs the borrower of their financial obligation, it also serves a few additional purposes.

First and foremost, it is used to remind the borrower that the unpaid debt exists. However, it is also seen as a vehicle to provide the borrower with directions to repay the debt. Finally, it is also important to note that sending this letter is often the first step in taking legal action to collect for a debt collector or debt collection attorney.

How to respond if a law firm is calling about a debt

If you’ve received a call or letter from an attorney regarding a debt that you owe, you’re probably wondering how to respond. Fortunately, no matter which method of communication the law firm has used to get in contact with you, the process for responding is pretty much the same on your end. In light of that, we’ve laid out the steps you should take below.

Know your rights under the law

To start, understanding your rights in the process of debt collection is crucial. The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects borrowers from mistreatment by debt collectors, regardless of the size of the balances they owe. While many protections are afforded to you under this act, we’ve taken the liberty of pulling out some highlights.

- Debt collectors cannot intentionally lie to you or engage in deceptive practices

- Collectors must provide you with information on themselves and the debts they are trying to collect

- Debt collectors cannot threaten you, repeatedly call you, or use obscene language

- Collectors cannot publicly reveal any debts that you owe

- Debt collectors cannot contact you at work if you request them not to do so

- Collectors cannot contact you before 8:00 AM or after 9:00 PM

With that said, if you believe a debt collector has treated you in a way that violates these protections, you are within your rights to file a report against them. Luckily, the Consumer Financial Protection Bureau (CFPB) offers a helpful online resource where you can file a complaint.

Keep in mind there are also state laws related to debt collection too.

Gather the necessary information

Next, you will want to gather as much information as possible on the attorney or debt collection agency and the debts they claim you owe. If you’ve received something in writing, you’ll probably be able to get this information from the letter itself. However, in particular, you’re going to want to gather the following information:

- Who is contacting you? (If possible, get the person’s name.)

- Which company or law firm do they work for?

- What are the company or law firm’s mailing address and phone number?

- What is the original creditor’s name to whom you owe the debt?

- How old is your outstanding debt?

- How much do you owe in total?

This information should be provided by the lender or collector in the form of a debt validation letter. If they can’t or won’t provide a debt validation letter, the debt might not be legitimate and could be a scam.

You’ll also want to ensure that the debt isn’t time-barred, meaning it hasn’t exceeded the statute of limitations on collecting the debt.

If a debt collector calls you or comes to your home, try to keep the conversation as short as possible. Be calm, courteous, and polite. Yet, do your best not to engage in any side conversations or threaten the debt collector or agency. Unfortunately, the personal information you provide could be used against you later as they try to collect the monies they claim you owe.

Contact an attorney

After you’ve gathered the necessary information, the next step is to get in touch with a debt relief attorney of your own. Often, when dealing with debt collectors or debt collection attorneys, it is best to have someone who has an intimate knowledge of the law on your side who can protect your rights. In addition, an experienced debt relief attorney can review your debts’ specifics and provide individualized advice on the best way to move forward. They’ll resolve debts in the best possible way without any ongoing repercussions.

If you don’t already have an existing relationship with an attorney, don’t hesitate to reach out to Tayne Law Group today. We offer a free phone consultation as part of our services. We can help you decide on the right course of action to take to resolve your debts once and for all.

The bottom line on receiving a letter from a law firm about debt collection

If you only take one thing away from this post, it should be that receipt of a debt collection letter is often a sign that the debt collector or debt collection attorney intends to take further action. Sending a letter like this is also often the first step toward additional legal proceedings. With that in mind, it is usually in your best interest to have legal representation in your corner before moving forward.

If you need help with a debt collection letter, Tayne Law Group is here to assist you. We’ve been in the debt relief business for over twenty years, and, in that time, we have won several awards for our work serving others. Call us at (866) 890-7337, or fill out our short contact form, and we’ll respond as soon as possible.

FAQs

When you receive a debt collection letter from an attorney, stay calm and carefully review the letter for details about the debt, including the amount owed and the creditor’s name. Before responding, verify the debt to ensure it’s accurate and that it belongs to you. If there’s any doubt, you have the right to request verification. Consider consulting with an attorney for guidance, especially if the debt seems unfamiliar. If you choose to respond, do so in writing, either acknowledging the debt or disputing it, and always keep copies of your correspondence for records.

To stop debt collectors from calling, familiarize yourself with your rights under the Fair Debt Collection Practices Act (FDCPA), which allows you to request that debt collectors cease communication. Draft a cease and desist letter indicating that you no longer wish to be contacted regarding the debt. Be specific in your request about how you wish to be contacted, if at all. Send your letter through certified mail to have proof of receipt. Retain a copy of this letter and any other related documentation. If the calls persist after sending your letter, consider reporting the collector to the Consumer Financial Protection Bureau or your state’s attorney general’s office.