Managing debt can be challenging at any age, but debt relief for seniors can be especially challenging when living on a fixed income. As retirement savings may not always cover unexpected expenses or accumulated debts, many seniors find themselves struggling to keep up with financial obligations.

In 2022, the average debt of consumers aged 65 to 74 was $134,950, according to the Federal Reserve.

However, with the right strategies and resources, it’s possible to manage and reduce debt effectively. Read on to learn how to manage and reduce your debt as a senior in retirement.

Types of Debt Commonly Incurred by Seniors

Seniors often incur several types of debt. This is due to a range of factors, including medical expenses, reduced income post-retirement, and financial obligations to family members.

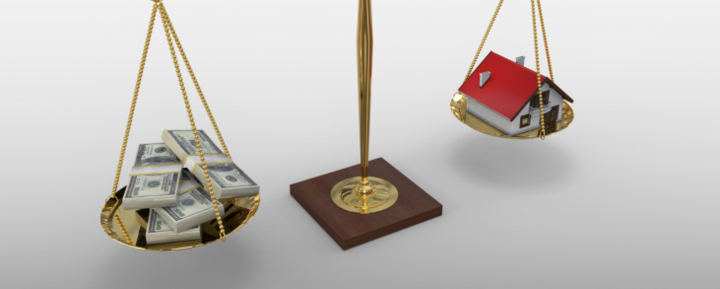

Mortgage and Home Equity Loan Debt

Many seniors still carry mortgage debt into retirement. This can be due to purchasing a home later in life or refinancing existing homes. Seniors might also tap into the equity of their homes to cover large expenses, including home repairs, medical bills, or even to provide financial assistance to family members.

Credit Card Debt

Fixed or reduced incomes can make it difficult for seniors to manage everyday expenses. This often leads to higher credit card usage and, subsequently, higher balances that are difficult to pay off, resulting in credit card debt for seniors.

Medical Debt

Health care costs and medical needs can escalate as seniors age, resulting in significant medical debt. This includes expenses for prescription medications, hospital stays, and long-term care facilities that are not fully covered by insurance.

Auto Loans

Seniors may have auto loans either from purchasing new vehicles or from refinancing existing auto loans. Auto loan debt can challenge a senior’s fixed budget, especially if that includes higher insurance costs.

Causes of Debt Accumulation Among Seniors

- Fixed or reduced income: Leaving the workforce to retire often means your income decreases as you shift from earning a regular paycheck to relying on fixed sources such as Social Security, pensions, or retirement savings. This decrease can make it difficult to manage ongoing expenses, especially if you don’t also downsize your lifestyle and cost of living. Living off credit cards can become a real possibility, leading to credit card debt.

- Healthcare costs: As people age, they often face increasing healthcare needs. Costs for medications, treatments, medical devices, and long-term care can be substantial. Insurance may not cover all expenses, leading seniors to rely on credit cards or loans to cover the gaps.

- Inadequate savings: Many seniors enter retirement without the necessary savings to support their lifestyle or unexpected costs. This is a major financial vulnerability that can lead to increased reliance on debt to manage daily expenses and emergencies.

- Supporting family: Seniors often provide financial assistance to children or grandchildren, even if it’s to the detriment of their own finances. They may be helping them with education costs, buying homes, or covering unexpected financial hardships, causing them to fall into a debt trap.

- Increased cost of living: Inflation and increases in the cost of basic goods and services can also erode the purchasing power of fixed retirement incomes, pushing seniors toward more debt to cover everyday expenses.

- Scams and financial abuse: Older adults are often targeted by fraudsters due to their perceived vulnerabilities. Seniors may be more isolated, experience cognitive decline, or be less familiar with technology. Unfortunately, all of these factors make them susceptible to being taken advantage of financially.

Debt Relief Options for Seniors

Before pursuing a debt relief program, it’s important to first take stock of your financial situation. List out all your debts, including the balances, interest rates, and monthly payments. Then create a detailed budget to get a better understanding of your income and expenses. Additionally, you should review your credit reports and scores to understand how the debts listed on the credit report impact your creditworthiness and borrowing power.

Once you have a clear snapshot of your current financial situation, you can pursue the appropriate debt relief option that makes the most sense for your finances and goals.

Credit Counseling

Non-profit credit counseling agencies can help seniors manage their debt through budgeting advice and debt management plans (DMPs). These are official repayment plans facilitated by credit counseling agencies, which negotiate with creditors to reduce interest rates and consolidate debt into a single monthly payment. This can make debt more manageable over time. However, keep in mind there may be costs associated with this type of assistance, even if you work with a non-profit.

Debt Settlement

Debt settlement involves negotiating with creditors to pay a lump sum that is less than the full amount owed. You can do this on your own, or a hire a third-party debt settlement attorney to contact creditors and negotiate a settlement on your behalf. Creditors may agree to a settlement to recoup a portion of the debt rather than risk you defaulting entirely or having to go the route of a lawsuit.

Once a settlement is reached, you make a one-time lump-sum payment, or begin structured reduced payments until the agreed amount is paid off, depending on the agreement. This approach can provide immediate relief from overwhelming debt, but it usually requires that you first stop paying creditors and accumulate enough money for the settlement offer.

Settling a debt for less than the owed amount may negatively affect your credit, since a missed payment is required and settled debts are noted on your credit reports. Additionally, the forgiven debt may be considered taxable income by the IRS, so it’s important to plan accordingly and work with a professional debt relief attorney who understands the nuances of the debt settlement process and can help guide you.

Also, keep in mind there is no guarantee that creditors will agree to a settlement. That’s why it’s highly recommended that you work with an experienced and reputable consumer debt help attorney.

Debt Consolidation Loan

Debt consolidation involves combining multiple debts (such as credit card bills, personal loans, or medical bills) into a single loan or payment plan, often with a lower interest rate. The main goal of debt consolidation is to simplify debt management by reducing the number of payments and potentially lowering the overall monthly payment. This can be achieved through various means, such as a personal loan, a home equity loan, or even a balance transfer credit card.

Be sure that if you pursue debt consolidation, you carefully review the interest rate, repayment period, and any associated costs of the consolidation loan to ensure you really do benefit financially in the long run.

Government Assistance Programs

Various federal and state programs offer financial assistance to seniors for basic living expenses, which can free up funds to pay down debt.

For example, Supplemental Security Income (SSI) provides monthly payments to seniors (65 and older), as well as blind or disabled individuals, who have limited income and resources.

Additionally, various programs are available for senior veterans, including pensions, disability compensation, and healthcare benefits. These benefits can alleviate financial burdens and help manage debt.

Some non-profit organizations and legal aid services provide free or low-cost legal advice and assistance with debt issues as well.

Legal Rights and Protections for Senior Debtors

Seniors have several legal rights and protections when dealing with debt. These protections are designed to ensure fair treatment and prevent abuse or exploitation. Here are some key examples:

1. Fair Debt Collection Practices Act (FDCPA)

- Protections: Prohibits debt collectors from using abusive, unfair, or deceptive practices by debt collectors to collect debts.

- Rights: Seniors have the right to request verification of the debt and can dispute any debt they believe is incorrect. Debt collectors can’t call at inconvenient times or places, and they must cease communication if requested in writing.

2. Truth in Lending Act (TILA)

- Protections: Ensures that creditors provide clear and accurate information about the terms and costs of loans and credit.

- Rights: Seniors have the right to receive detailed information about interest rates, fees, and payment schedules before agreeing to a loan or credit arrangement.

3. Equal Credit Opportunity Act (ECOA)

- Protections: Prohibits discrimination in credit transactions based on age, race, color, religion, national origin, sex, marital status, or receipt of public assistance.

- Rights: Seniors have the right to apply for credit without fear of discrimination and can request reasons for any adverse credit decisions.

4. Older Americans Act (OAA)

- Protections: Provides a range of services to help seniors maintain their independence and financial security.

- Rights: Seniors can access services such as legal assistance, financial counseling, and advocacy to help manage debt and financial issues.

5. Exemption Laws

- Protections: State and federal laws protect certain types of income and assets from creditors.

- Rights: Seniors can claim exemptions to protect Social Security benefits, retirement accounts, disability benefits, and other essential assets from being seized to pay off debts.

6. Consumer Financial Protection Bureau (CFPB)

- Protections: The CFPB provides oversight and enforcement of consumer protection laws.

- Rights: Seniors can file complaints with the CFPB about unfair or abusive financial practices and receive assistance in resolving disputes with financial institutions.

Steps to Take Before Opting for Debt Relief Solutions

Before pursuing a debt relief program, seniors should first assess their financial situation by listing all debts, noting balances, interest rates, and monthly payments, as well as creating a detailed budget to understand their income and expenses. They should research various debt relief options such as credit counseling, debt management plans, debt consolidation, debt settlement, and bankruptcy, and consult professionals like financial advisors, credit counselors, or attorneys who specialize in senior debt relief to get tailored advice.

It’s crucial for seniors to check their credit reports and scores to understand how their debts impact their creditworthiness. They should evaluate potential debt relief agencies, choosing those with good reputations and accreditation from organizations like the NFCC or FCAA, and checking reviews and complaints with the BBB and CFPB. Understanding the costs and risks associated with each debt relief option is essential, including any fees, the impact on credit scores, and the possibility of scams.

Consulting legal and financial advisors can provide deeper insights, especially when considering bankruptcy. Seniors should also explore alternative solutions like negotiating with creditors directly, seeking government assistance, or getting help from family members.

Considering the long-term implications on retirement plans and overall financial goals is vital. Seniors should ensure essential assets like their home and retirement accounts are protected. After weighing the pros and cons of each option and considering professional advice and personal research, they should make an informed decision that aligns with their financial needs and goals.

How to Choose a Reputable Debt Relief Agency

Choosing a reputable debt relief company involves thorough research and careful evaluation.

Start by looking for agencies accredited by reputable organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). You can also check reviews and complaints with the Better Business Bureau (BBB) and the Consumer Financial Protection Bureau (CFPB) to ensure the company has a good reputation. Transparency about fees is also key; a reputable agency will clearly outline their fee structure without requiring large upfront payments or using aggressive sales tactics.

Another option is to work with a debt help attorney who is ethically obligated to put your best interests first. Attorneys can handle complex legal situations, including bankruptcy filings, lawsuits from creditors, and protecting assets. They are also trained negotiators who can often secure better terms from creditors or more favorable debt settlements and have a higher level of accountability than a typical debt relief company.

Strategies for Managing Debt in Retirement

Managing debt in retirement requires careful planning and strategic actions to ensure financial stability and peace of mind.

Downsizing and Cost Reduction

Downsizing and reducing expenses can improve your financial security in retirement. Evaluating housing options is a crucial first step. For example, consider selling your current home if it’s larger than needed or costly to maintain. You can use the proceeds to buy a smaller, more affordable home or rent a more economical property.

Renting instead of owning can also eliminate property taxes, home maintenance costs, and potentially reduce monthly housing expenses. Alongside housing adjustments, decluttering your belongings can further ease the transition. Selling unneeded items can boost savings or help pay down debt, while donating or giving away items can cut down on moving costs.

Creating Multiple Income Streams

Leveraging Home Equity

If you’re a homeowner, you may be able to take advantage of the equity in your property to reduce other high-interest debts.

For example, a home equity loan allows you to borrow a lump sum of money using your home as collateral. This type of loan typically offers a fixed interest rate and set repayment terms. By using a home equity loan, seniors can pay off high-interest debt, consolidating their obligations into a single, more manageable monthly payment at a lower interest rate.

Similarly, a home equity line of credit (HELOC) functions like a credit card, offering a revolving line of credit that you can draw from as needed. This option provides flexibility, as you only pay interest on the amount borrowed. Seniors can use a HELOC to manage cash flow, cover unexpected expenses, or pay down debt incrementally. The interest rates on HELOCs are usually lower than those of credit cards or personal loans.

Another option to consider is a reverse mortgage. This allows seniors age 62 and older to convert a portion of their home equity into cash. Unlike traditional mortgages, reverse mortgages do not require monthly mortgage payments. Instead, the loan is repaid when the borrower sells the home, moves out permanently, or passes away. Reverse mortgages can provide a steady income stream or a lump sum to pay off existing debt, but it’s crucial to understand the fees and impact on home equity before proceeding.

Applying for Benefits and Assistance

There are various benefits and assistance programs available for seniors trying to manage their debt. These programs can provide financial relief, help with living expenses, and offer resources for better financial management. Here are some key examples:

- Medicare: Federal health insurance program for seniors 65 and older, covering hospital stays, medical visits, and prescription drugs. Reduces out-of-pocket medical expenses.

- Medicaid: Provides health coverage for low-income seniors, covering a broader range of services than Medicare. Can help with medical expenses not covered by Medicare.

- Medicare Savings Programs: Assist with Medicare premiums, deductibles, and co-payments for eligible seniors.

- Supplemental Nutrition Assistance Program (SNAP): Provides funds to purchase food, helping seniors free up money for other expenses.

- Meals on Wheels: Delivers nutritious meals to homebound seniors, reducing the need for grocery shopping and meal preparation.

- Section 8 Housing Choice Voucher Program: Provides rental assistance to low-income seniors, helping to reduce housing costs.

- Low-Income Home Energy Assistance Program (LIHEAP): Helps with heating and cooling costs, reducing utility bills.

- Property Tax Exemptions: Many states offer property tax exemptions or reductions for senior homeowners, reducing housing costs.

- Tax Credit Programs: Federal and state tax credits can reduce the overall tax burden for low-income seniors.

- Senior Community Service Employment Program (SCSEP): Provides part-time job training and employment opportunities for low-income seniors, helping to supplement income.

- Senior Centers: Offer social, recreational, and educational activities, often providing meals and transportation services.

- Non-Profit Organizations: Many non-profits provide various forms of assistance, including financial aid, housing support, and emergency funds.

How Tayne Law Group Can Help Seniors in Debt

And if you’re struggling with debt and don’t know where to turn, Tayne Law Group, P.C. is here for you. Our team of debt professionals can help you get back on the road to financial freedom. Call us for a free phone consultation at 866-890-7337 or fill out our short contact form, and we’ll get in touch. We never share or sell your information and all calls are confidential.